Best Business Credit Cards for Small Businesses in 2026 (High Limits & 0% APR)

Best 0% APR Business Credit Cards for Startups

Best Business Credit Cards for Small Businesses in 2026 (High Limits & 0% APR)

Choosing the best business credit cards for small businesses in 2026 can significantly improve your company’s cash flow, purchasing power, and long-term growth. With competitive 0% APR offers, high credit limits, and premium cashback rewards, business credit cards have become essential financial tools for entrepreneurs.

Why Small Businesses Need a Business Credit Card

A dedicated business credit card helps separate personal and business expenses, build strong business credit, and unlock higher approval limits. Many financial institutions now offer flexible approval requirements, even for startups and new LLCs.

- Build business credit history

- Access high limit business credit cards

- Earn cashback and travel rewards

- Improve short-term cash flow

Best 0% APR Business Credit Cards in 2026

One of the most attractive options in 2026 is the 0% APR business credit card. These cards allow small business owners to finance purchases without paying interest for 12 to 18 months.

They are ideal for:

- Startup funding

- Inventory purchases

- Marketing campaigns

- Equipment financing

When comparing 0% APR business credit cards, look for no annual fees, strong rewards programs, and flexible approval requirements.

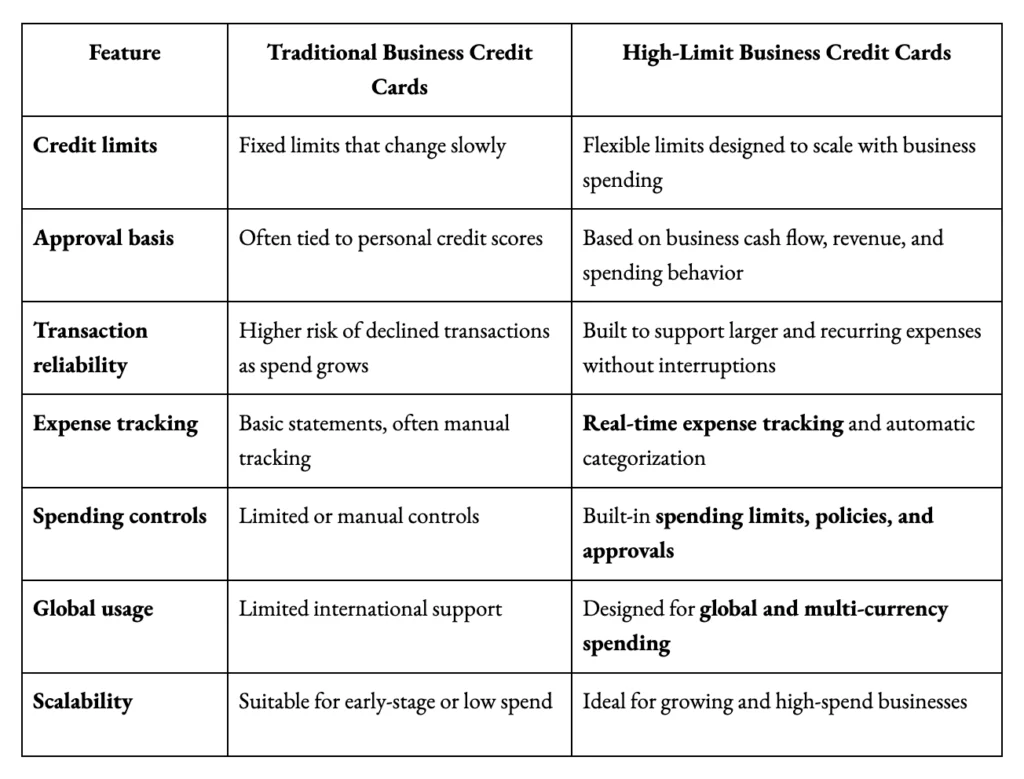

High Limit Business Credit Cards

High limit business credit cards are designed for companies with large monthly expenses. Many premium cards offer limits starting at $25,000 and can exceed $100,000 depending on revenue and credit profile.

Benefits include:

- Higher purchasing power

- Corporate expense tracking tools

- Employee cards at no extra cost

- Premium travel rewards

Business Credit Card Approval Requirements

To increase your chances of approval for the best business credit cards in 2026, you typically need:

- Credit score of 680+

- Registered business entity (LLC, Sole Proprietor, Corporation)

- EIN or SSN

- Proof of business income

Even startups can qualify using their personal credit history. Many lenders now support new entrepreneurs with flexible underwriting models.

Business Credit Cards With No Annual Fee

If you want to reduce fixed expenses, consider business credit cards with no annual fee. These cards still provide cashback rewards, fraud protection, and purchase security.

This option is ideal for freelancers, consultants, and online businesses looking to maximize profitability.

How to Choose the Best Business Credit Card

Before applying, consider the following:

- Do you need 0% APR financing?

- Do you prefer cashback or travel rewards?

- How high of a credit limit do you need?

- Is an annual fee justified by rewards?

The best business credit cards for small businesses combine strong rewards, flexible financing, and scalable credit limits.

Final Thoughts

In 2026, small businesses have more financing options than ever before. Choosing the right business credit card can help optimize cash flow, build long-term credit strength, and unlock powerful rewards.

If you’re serious about scaling your company, selecting the best business credit card is not just a convenience — it’s a strategic financial decision.